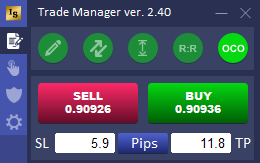

Option 2: Using “Back_Candles” method to place Stoploss Hereafter is an example of using ATR = 14, factor = 2, it shows a good stoploss position. To use ATR stoploss, you need to pay attention to three paramenters as in the red box, the rest options of stoploss are ignored. By using a certain percentage of ATR, you ensure your stop is dynamic and changes appropriately with market conditions.įor example, in above screenshot, the default value of ATR which is common practice setup, you can always change them in your favour. It is common to see many traders determine stoploss based on Average True Range (ATR) value, this is because ATR represents for current volatile market condition a higher ATR indicates a more volatile market, while a lower ATR indicates a less volatile market. There are four options to place Stoploss which help you to define and place a suitable stoploss according to the market conditions and your strategy. For example, you risk 1,000 USD for a trade, it will calculate respective volume regardless the stoploss is 30 or 50 pips. The EA will place stoploss per your instruction, no matter the stoploss is narrow or wide that does not impact to the above risk volume and TP. The next step is setup Stoploss which is ultmost important for any trade, the next part will explain how Trade Manager assist you to this job in a simple way. Now, you completed plan for risk amount and TP, these parameters will be saved and resued for onward trades, you do not need to redo it for every trade. The TP will be automatically calculated based on your setup Stoploss. Reward_Risk Ratio: this is your expected Take Profit (TP), the default value is 2 which means that the expected profit is double amount of your trade amount. If both fields are setup with non-zero value, the value of Risk Amount (priority) ($) will be processed for the trade while value of Risk Percent (%) is ignored. For example, your balance is 100,000 USD and Risk Percent (%) is 1, that means the trade amount will be 1,000 USD. Risk Percent (%): indicates the percent of balance that you want to risk for a trade. It is noted, it may not provide exact volume of trade to the money amount, there is a small difference. Risk Amount (priority) ($): How many dollars that you want to risk in each trade, the EA will calucate an approximate value of volume responding to money amount. Example, the default value is 1, the EA wont make any new order if there is an existing possition on the current pair. MaxAmountOfTrade: the maximum number of positions are allowed to place in the current chart. Setup risk volume and take profit for your tradeĮxplanation for the above paramters in the red boxes:.Setup Entry Parameters Template For Future Trades What kind of order to place: Market Buy/Sell, or Pending Buy/Sell ?įorex Trade Manager EA will help you to emplement mentioned above requirements in a fast maner once placing a trade with multiple options. How much is expected profit ? Is it fixed R:R (eg. Where is for a safe Stoploss that offers a good R:R but not easily to be hit ?Ĥ.

How much do you risk for the trade in amount of money (e.g 1,000 USD) or percent of balance (e.g 1% of balance) ? It is quite tough for you to calculate volume for this purpose once trading without auto-calculator tools.ģ. However, once price definitely meets an entry strategy, place a trade order as soon as possible is needed for every trader.īefore placing an order, it should be planned in advance below main points:Ģ. This may not true for senior traders who consider whether the market met their strategy, then they would place an order in a calm-mind. It is popular to see that many new traders wanted to place a postion (BUY/SELL) in a second urgently as the price may move rapidly making them lose a good entry point.

0 kommentar(er)

0 kommentar(er)